flow-through entity tax form

Choose PTET web file from the Corporation tax or Partnership tax expanded menu then select Pass-through entity tax PTET estimated payment. In contrast C Corporations face double taxation.

Pass Through Entity Tax Treatment Legislation Sweeping Across States Bkd Llp

Tax Guide for Pass-Through Entities.

. For tax years beginning on or after January 1 2021 an authorized person can opt in to PTET on behalf of an eligible entity through the entitys Business Online Services account now through October 15 2021. With the fast approaching state tax compliance deadlines PTEs and their owners are intensifying their attention on these taxes. Calendar year 2021 has continued the trend of pass-through entity PTE tax proposals.

It is not a replacement for the regulation and for greater detail please refer to the regulation. For tax year 2020 only a fiduciary member of an electing PTE reports the electing PTE credit on Line 29 of Form 504. Overview of Flow-Through Entity Tax.

Finally due to the nature of this retroactive application to 2021 tax situations quarterly estimated payments of tax otherwise due for tax year beginning in 2021 will not accrue any penalty or interest. The tax rate at the entity level the Varnum article explained is 425 the same as the individual income tax rate. Accordingly schedules and forms are compiled for separately stated items of income.

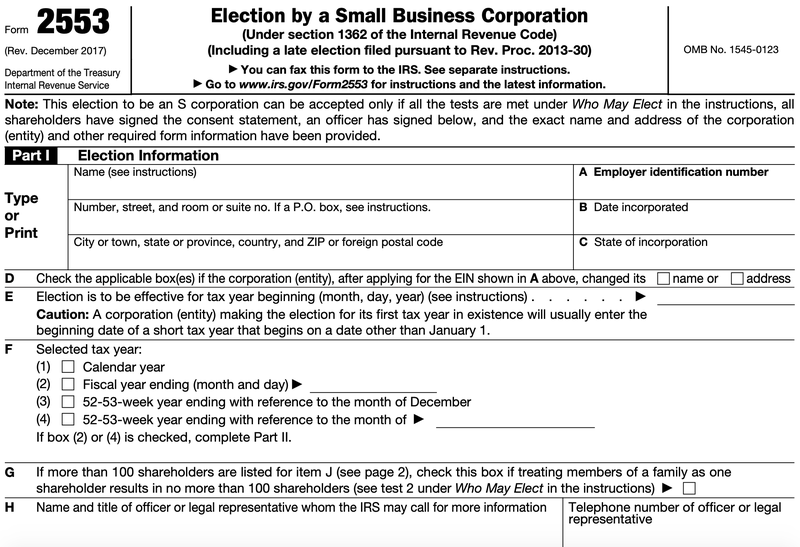

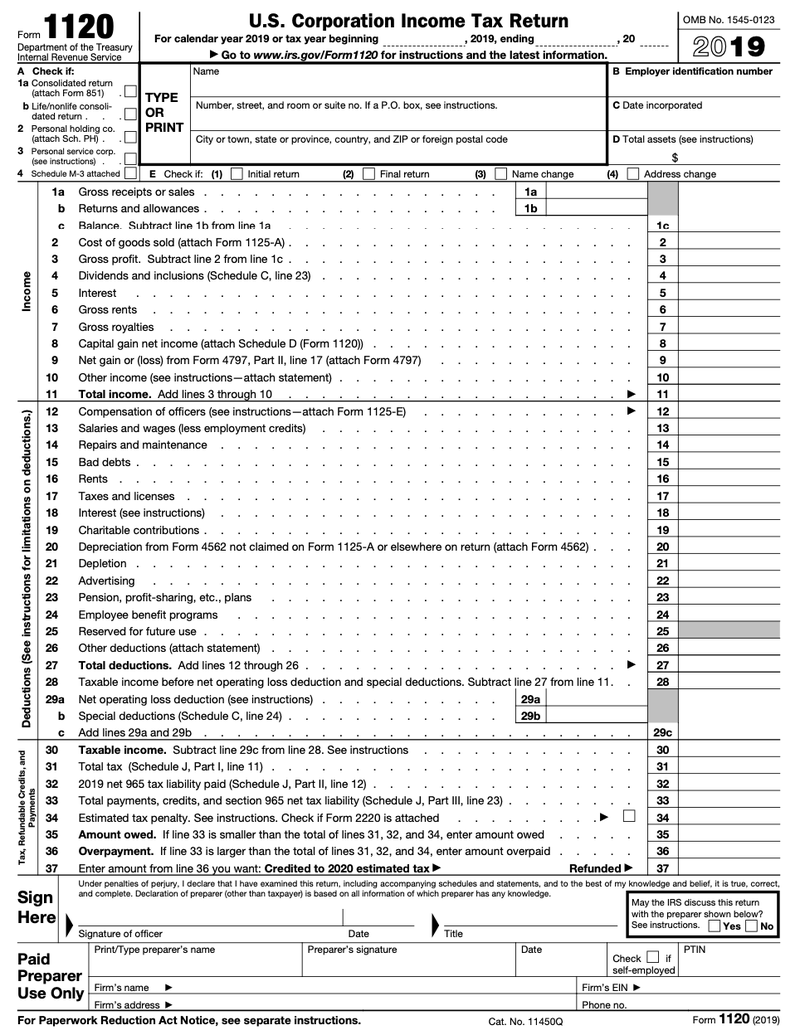

For tax years beginning in 2021 flow-through entities have until April 15 2022 to make this election which will be irrevocable for the next two tax years. 2021 PA 135 introduces Chapter 20 within Part 4 of the Income Tax Act to create and levy a flow-through entity tax on electing flow-through entities with business activity in Michigan effective January 1 2021. With an election in place and payment of the necessary taxes the pass-through entity can then deduct the amount of taxes paid without limitation on their federal tax returns Form 1120S for S corps Form 1065 for partnerships.

A flow-through entity also known as a pass-through entity or fiscally-transparent entity is a legal business entity where its profits flow directly to the investorsowners and only the investors or owners are taxed on the income. PTEs and their owners should take these taxes into account when determining the impacts at the entity and owner levels. The tax is imposed on the positive business income tax base after allocation and apportionment.

Instead the business income passes through the business to their owners and the owners pay tax for the first time on their personal tax returns. The pass-through entity must file its annual return and make the. We are developing the following tax forms for qualified entities to make the PTE elective tax payments and for qualified taxpayers to claim the tax credit.

Is A Partnership A Flow Through Entity. On Schedule D of the partners Form 1040 is an example of capital gains that is reported on Schedule K-1. A flow-through entity does not pay federal corporate tax.

Received for the tax paid by the electing pass-through entity. On Line 1 of Form 504. If the entity does not have a Business Online Services account the authorized person will need to create one.

Flow-through entities This section provides information on the types of investments that are considered flow-through entities and how to calculate the capital gain and loss resulting from the disposition of shares of or interests in a flow-through entity. A foreign partnership is any partnership including an entity classified as a partnership that is not organized under the laws of any state of the United States or the District of Columbia or any partnership that is treated as foreign u. Learn more about pass-through entities including registration and withholding information.

Flow-through Entity Tax Quarterly Estimated Tax Payments for Tax Years Beginning in 2021 Not Subject to Penalty or Interest. For tax years beginning in 2021 flow-through entities must make this election by April 15. Pass-Through Entity Elective Tax Payment Voucher FTB 3893 Pass-Through Entity Elective Tax Calculation FTB 3804 Pass-Through Entity Elective Tax Credit FTB 3804-CR.

A flow-through entity includes S corporations partnerships and limited liability companies that have elected to be treated as either S corps or partnerships other than publicly traded partnerships for federal income tax purposes. Fiscal year flow-through entities elected into the tax will pay quarterly estimated tax on due dates determined in accordance with that entitys fiscal year. A flow-through entity is a legal business entity that passes any income it makes straight to its owners shareholders or investors.

Entities must use our online Web File application and pay by ACH debit when making PTET payments. October 2021 Department of the Treasury Internal Revenue Service. Generally the flow-through entity tax allows a flow-through entity to elect to pay tax on certain income at the individual income tax.

Section references are to the Internal Revenue Code. The flow-through entity tax will be imposed on the entitys allocated or apportioned positive business income tax base at the same rate as the individual income tax currently 425. Schedule E of Form 1040 which is typically filled out by a partner will report their ordinary partnership income.

The flow-through entity tax is computed at the same rate as the individual income tax which for the 2021 tax year is 425. This guide will help taxpayers comply with the rules in regulation 830 CMR 62B22. Eligible pass-through entities must register for the 63D-ELT tax type before making a payment.

Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. For tax year 2020 only report the addback by entering the total of federal taxable income plus the amounts from 510K-1 Part D Lines 2. Do not make 63D-ELT payments on other pre-existing tax types.

Branches for United States Tax Withholding and Reporting. Notice Regarding the Implementation of the Michigan Flow-Through Entity Tax. The tax base for the flow-through entity tax includes the positive business income of owners who are individuals passthrough entities estates and trusts but not including distributive allocations of loss to a particular owner or the distributive or prorated income allocation to an owner that is a corporation insurance company or financial.

Pass Through Taxation What Small Business Owners Need To Know

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Understanding The 1065 Form Scalefactor

What Is A Pass Through Entity Definition Meaning Example

A Beginner S Guide To Pass Through Entities The Blueprint

How To File Tax Form 1120 For Your Small Business The Blueprint

Pass Through Entity Definition Examples Advantages Disadvantages

Pass Through Entity Definition Examples Advantages Disadvantages

How To Fill Out Form 1065 Overview And Instructions Bench Accounting